Disclaimer: I am not a financial advisor. The content below is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. I am a London based entrepreneur who has been fascinated by the Web3 space over the past year. These are personal observations only. With that in mind…

Non Fungible Tokens (NFTs) thundered into the public realm in 2021. Maybe it was the $69m Beeple sale at Christie’s or the SNL parody, but by early spring, if you read the news, you at least heard the term.

As founder of Rise Art, I’ve worked across art and tech for over 12 years, and collected art for even longer. At Rise Art we’ve pioneered art rentals online, hosted an international prize and launched a gallery in London. I’ve been exposed to every fad, trend, technology and movement during this time. And I’ve seen first hand the huge margins that dealers and flipper collectors can get away with on secondary sales due to the inaccessible and opaque nature of the traditional art market.

When I first heard about NFTs, I was tempted to dismiss the medium as another crypto hype, like the ICO craze of 2017. But over the last 6 months, I have come to believe that NFTs are quite possibly the most exciting convergence of technology and art to come about during my professional career.

In the past 6 months I’ve bought and traded NFTs, staked crypto, trawled through hundreds of discord community channels, set up an NFT investment DAO with 30 other tech entrepreneurs, attended an NFT art fair, visited multiple NFT exhibitions and spoken to many of the companies, artists and entrepreneurs that are helping to define the NFT landscape.

In this article, I’ll outline the following:

- Beginnings, understanding NFTs and the value for artists

- Learnings from my first NFT acquisition

- DAOing

- Transaction costs, gas and the side chain opportunity for artists

- Early lessons and how to get involved

But first, why am I writing this?

As more and more of my friends, co-workers and family ask about NFTs and why they should care, I wanted to share some of my learnings from six months of more than a few humbling experiences punctuated by a few wins in the space. Why?

First, I believe that Web3 and NFTs, while still emerging, will re-define how we interact with brands, how we collect and how we share experiences. I see a future where some of the next truly disruptive companies (gaming, art, collectibles, consumer brands) emerge from Web3. The communities around these decentralised organisations are still in their infancy, and I’ll show you why I am so excited about the potential for them to shape how brands are created and evolve.

Second, I have learned so much and had so many people help me out. From explaining basic things to a complete nOOb, to providing introductions and access to some amazing projects, countless friends and strangers have been overly generous with their time . I now have a lot of people asking me what I am doing in NFTs and why. I hope my mistakes and learnings will help others just starting to dip their toes into this exciting new medium.

And finally, my story is not one of immediate success. I’ve had some wins and many stumbles. Twitter and Discord are full of stories of whales who invested super early in projects and have made millions on crypto and NFTs. I am not one of them…yet. I wanted to share what six months in NFTs is like for a new account and to share some perspective on the space.

So if you’re still reading and I haven’t lost you, let me take you on a journey…

The beginnings — Understanding NFTs

It wasn’t until January of 2021 that NFTs started to really enter my consciousness. I was doing a series of Clubhouse conversations (remember those?) during the UK COVID lockdown when my only interactions with others seemed to be online. In one room, I had the extremely generous curator and artist Kenny Schachter on a show. We spent the better part of an hour discussing all things NFTs and Kenny’s releases and experiences to date. I admit that I left the conversation more confused than I had been coming in, and over the next months, sat on the sidelines, watching and learning the fundamentals. (Probably a huge mistake, as I watched the value of a CryptoPunk go from $10k to $250k in that period — But I digress).

Non-Fungible Tokens or NFTs are defined as “a unique and non-interchangeable unit of data stored on a digital ledger”. This definition didn’t do much for me. But, when Robert Norton, founder of Verisart explained them as “a way to turn anything into something” it was the lightbulb moment.

NFTs establish authenticity, which creates value. Whether it is art, collectibles, tweets, poems, or memes, digital items can now be turned into a unique asset through this new medium. Suddenly ownership of a digital asset can be defined and documented, exchanged and validated. Artists and creators can now build contracts with defined benefits for the token holder, and set the rules and royalties due on every subsequent sale of the token. This is huge for artists, as they suddenly are able to participate and share in the upside of every future sale of their creative asset.

If you’re not familiar with other basics — There are many online sites that explain all the terms I list below in detail. Web3 and the NFT space are full of jargon, slang and memes, but once you are familiar with the basics it is easy to engage. I also highly recommend reading Dan Murray-Serter’s introduction to NFTs. It supercharged my continued interested in NFTs and if it doesn’t get you excited in the space, I am not sure much else will.

Learnings from my first NFT acquisition

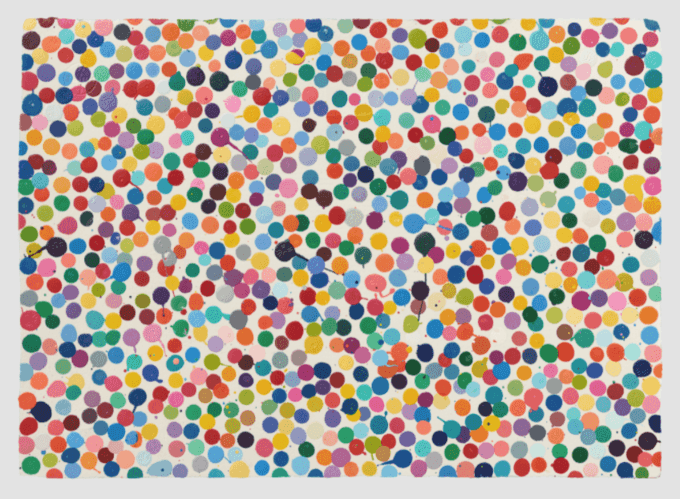

The work that kicked off my NFT collection — Damien Hirst “In Love with a Person”

I acquired my first NFT last July, when I entered a lottery for and was allocated an NFT for Damien Hirst’s project “The Currency”. In this genesis NFT by Hirst, 10,000 physical works were created, and paired with an NFT which can be “burned” and exchanged for the physical work within roughly a year of the mint. If not exchanged, the work is destroyed and the NFT becomes the artwork. While the project accepted payment in fiat currency, the process involved setting up a digital wallet, transferring assets into crypto and learning how to execute and sign digital contracts. I installed Discord on my laptop, joined The Currency Discord Server, and dove into the conversation. I quickly learned a few things that have stuck with me on NFTs.

First, for many NFTs, the community around the NFT is more valuable than the NFT itself and if the community dies, the value of the NFT dies with it. Within The Currency Discord, there was a rich network of people discussing the works, new projects, the market and all things contemporary art.

Historically, when I bought physical artworks, once I purchased and hung the work, that was largely the end of the experience apart from my own ongoing appreciation or the occasional comment by a friend. Now, with digital NFTs I became part of a community of Hodlers who share the same interest and have a way to communicate with one another.

While the current viewing experience of NFTs is nowhere near that of physical art, I think over time this will change. In the coming years, the way we think of the distinction between the “real” and the digital is going to evolve in a fundamental way. Improvements in digital displays, enhanced interoperability between chains, and the evolution of the Metaverse will put NFT’s on par with physical works, just consumed in a different way.

Second, the transparency of NFTs has re-defined my idea of what it is to collect something. While the identities of NFT holders are private, it is suddenly possible for anyone to monitor each transaction in a collection. You can see what other wallets are collecting, and discovery and pricing are available in real time. It was a wild ride to watch the currency sales go from 1ETH to 20ETH and back to under 5 in a matter of months. The liquidity, floor price and what traits if any within a collection command higher values are all instantly visible.

In the case of The Currency, HENI (who collaborated with Hirst to publish the release) has even set up a monthly report which provides data and analysis on sales to date. Having worked in the physical art world, where price discovery is difficult and an entire industry of dealers, advisors and speculators make their living on insider access and arbitrage, this level of transparency is a game changer. While greater transparency isn’t necessarily desired by many participants in the art market with entrenched interests, I believe it will ultimately make the industry much more accessible to new collectors, expand the market and put more of the financial rewards in the hands of artists over agents.

Finally, NFTs are changing what it means to build a brand moving forward. I believe that some of the strongest new brands in the next five years will emerge from NFT projects. The currency community is evolving beyond Hirst’s initial drop. Hodlers have been airdropped an additional Hirst work free of charge, and sent gifts such as this umbrella. The evolution of the project spurs additional engagement, which increases the volume (and potentially value) of transactions, providing Hirst and Heni with additional income through royalty receipts. The cycle continues as Heni reinvests more back into the platform. Community members also play an active role in developing the brand and suggesting features and projects. In some NFT projects, community members become owners through coin releases and end up with a stake of the projects value.

Some NFTs are simply access tokens to community membership. One of my personal favourites, Poolsuite, is an executive membership NFT that provides 2500 hodlers with access to VIP experiences online and off. The community believes in the values and vision of the founders, and as the team starts to deliver on the roadmap, the strength and value of the community continues to grow. Moving forward, I think that many memberships brand interactions will be via digital NFT access tokens that can be freely traded and profits shared with the community as value is generated. This is a big deal.

Poolsuite Executive Membership— An access NFT to a growing lifestyle brand

DAOing

In the months that followed that first purchase, my journey into NFTs broadened into a number of different areas. Despite missing the boat on Board Ape Yacht Club and Cryptopunks, I purchased a number of Profile Picture (PFP) NFTs, got into Generative Art and most recently invested and played a handful of blockchain games.

This October, along with 30 other entrepreneurs, I also started one of the first European NFT Decentralized Autonomous Organization (DAO): UpsideDAO. Together, using our shared experiences and expertise we’ve invested nearly 150 ETH in assets across sectors. The initial aim of the DAO has been to generate returns, learn from each other and have a bit of fun. Given how fast the Web3 space is moving, leaning on the collective wisdom of the community has exposed me to a number of interesting opportunities I would have never come across on my own. We do regular sessions and tutorials, providing POAP tokens to attendees after each event.

Investing alongside the DAO has also provided me with exposure to assets that I would not have been able to acquire on my own with the limited funds at my disposal. Through the DAO, I have shared ownership in NFTs including MAYC, CrypToadz, Clonex, Rare Pepes and CryptoDickButt OG series.

CryptoDickbutt #48 — DAO purchase. The history of CDB makes them highly collectible, but try explaining that to someone new to NFTs. My wife remains highly sceptical

Beyond being a cool way to invest alongside frens in the space, the process of setting up and taking part in a DAO has been really interesting. While getting a decentralised community of individuals to work well together and make decisions quickly has its hurdles, the potential for DAOs to change the way companies are organized is huge. The structure and transparency of DAOs make them so much easier to manage than a traditional startup cap table. As more issues around governance and taxation are solved and standardised for DAOs, they could change the way commercial companies operate, attract and manage stakeholders.

Transaction costs, Gas and the side chain opportunity for artists

Overall, since starting out, most of my acquisitions have been in the hundreds of pounds — at this point, my main goal has been to experiment and learn without risking too much capital. Most of my early collection has been on the Ethereum blockchain. The chain is by far the largest NFT platform by value and wallet holders, but, as a level one proof of work network Etheruem has gas fees associated with every transaction that can reach into the hundreds if not thousands of dollars per interaction at peak times. The computing power required to validate these transactions is also extreme, and is one of the current drawbacks of proof of work networks — the energy used is unnecessary and terrible for the environment and climate change.

Gas fees enable the validation of the blockchain ledger and confirm ownership of an asset to an individual wallet, but the sheer cost of these interactions means that many emerging artists have been priced out from launching new NFTs on Ethereum. When gas prices are in excess of the price to mint an artwork, trading inexpensive NFTs ceases to make sense for the collector and listing works become difficult in both the primary and secondary markets.

Side chains that operate on Proof of Stake networks such as Tezos and Solana reduce these transaction costs to mere dollars per interaction, while being significantly less resource and energy intensive. As I have become more confident in the process of discovering, evaluating and purchasing work, my interest has expanded beyond Ethereum. I now am increasingly looking at buying on Tezos, and have really gotten into platforms such as fxhash and Objkt.

You can see a selection of some of current assets on Etherium and Tezos on my opensea, fxhash and objkt profiles.

Himinn #299 by Sarah Ridgley — An early Generative Art Purchase

In these accounts, you’ll see a bunch of NFTs with little value, alongside a few outliers. The reality is that a majority of the NFTs I have purchased are priced around where I bought them and more than a few are more than likely totally worthless. To date, less than 15% of my overall purchases have returned significant value, and fortunately, a few like the Hirst generated outsized returns (on paper). Many of the others are long term holds for artists I believe in and want to support.

Early lessons and how to get involved

The past 6 months of investing has taught me an incredible amount about how I will approach NFTs in 2022. Here are my top tips:

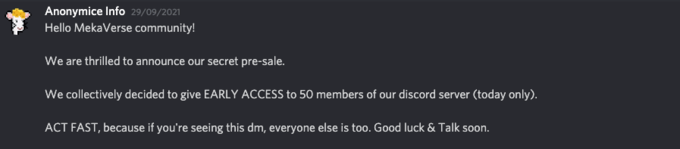

Be overly cautious — Web 3 customer support doesn’t exist

It’s early days in WEB3, and the entire space is filled with stories of individuals losing their entire collections or crypto balances to bad actors. I’ve had many heart in throat moments over the past few months as I have wondered whether a transfer has gone through or if I accidentally clicked on a malicious link. From leaking a seed phrase of your wallet (never tell anyone this) to purchasing a fake collection or transferring crypto to an unsupported wallet, there are plenty of ways to lose assets or be taken advantage of. When starting out, start out small. Read about best practice when setting up your wallets, and if you are going to have a lot of assets tied up in crypto and web3, invest in a cold storage wallet (I purchased a Trezor Model T) . Finally as a rule on Discord, just don’t click on any direct message links or reply to DMs from anyone you don’t know. Almost every inbound message I have received on the platform has been spam, or of a malicious intent.

An example of one of the thousands of fake Discord DMs I’ve received posing as real collections

Do Your Own Research (DYOR):

Discord communities, twitter and podcasts are all great sources of information for information on new projects and releases but often are nothing more than hype machines put together by people trying to promote their own bags. Many of the projects I regret going into are projects I didn’t understand much about, but (falsely) assumed there was tons of momentum behind. It’s easy to get caught up in the hype around a new project, but after a burst of initial energy and enthusiasm a lot of projects die a slow death as the community and developers move on to new things. When looking at a new project, I now think about the following four areas to assess the potential value:

- Who is the team or artist behind the project? Are they experienced, is this an artist or team with depth in the sector or relatively unproven talent? Check the Twitter profiles of people involved — what is their track record and do they deserve your trust based on prior work?

- What is the community around the project look like? Does the artist / project have a strong Twitter/Discord following, is there general buzz and enthusiasm around the release and are people organically sharing and expressing enthusiasm around the release? Often developers will try to game this by creating bot users or running competitions to artificially increase numbers. Just looking at the number of Discord server members in a project isn’t enough. Do some digging and understand the real momentum.

- Strength of project: What is new, different, unique and exciting about this project or artwork? What is the challenging differentiator that this project is doing and pushes the boundaries and makes it stand out? Read the white paper, roadmap or concept behind the project.

- Most importantly, my final criteria is whether or not I like the project — the aesthetic of the art or the concept of the project. I have a few pieces of art in my wallet that I can’t stand looking at. I’ve resolved not to let this happen moving forward. It’s entirely possible that any NFT purchase will go sideways, so if that happens, at least I am going to invest in projects that I find personally of interest and would enjoy looking at regularly.

Find Frens you can learn from

Taking part in trusted communities and learning from people with a diverse range of experiences and interests has accelerated my own development in the space and also exposed me to projects and opportunities I would have never found on my own. The DAO has been a particular wealth of experience for me, but even without that, following different servers on Discord, engaging in podcasts following and twitter accounts of influential Web3 artists and developers yields a wealth of information. Some of my favourites include:

- Podcasts: Modern Finance, Invest Like the Best -Web3 episode, Web3 Breakdowns

- Twitter: Punk6529, DCinvestor, Deeze,Ciphrd, Snowfro, Pixelportraits.eth

- Discord: Fractal (Gaming), FxHash (GenArt), Institut (Curated Art Platform

- Instagram: Kenny Schachter

Discover & Directly Support Artists

Web3 is a huge boon for digital artists. Generative Art, digital and video artists suddenly have a new channel to develop collectors and commercialise their art. And unlike mediums of the past, through royalties on ongoing sales, the incentives are aligned with collectors and artists sharing in the upside of continued secondary sales.

Discovering and supporting artists early in their Web3 careers is exciting and can be both financially and emotionally rewarding. As an example, through the DAO I learned about the work of German artist Artist Kim Asendorf. The artist is known for being the pioneer of a process called Pixel Sorting in his artwork, which adds a unique glitch effect to the output. While a practicing artist for over a decade, the artist took a nearly four year break from the art world when he was unable to find a reliable market for his practice. Since experimenting with NFTs as a medium over the past year, the artist now has a solid following and is able to fully support himself on initial artwork sales and proceeds from royalties. I’ve collected his work directly and chatted with him over Twitter and video. It has been a rich and rewarding experience and I love having his work in my collection.

Experiment small and have fun

The great thing about NFTs and WEB3 in general is that you don’t have to start big to learn and get involved. And the best way to learn is simply to take part. Whether it is learning about different DeFi projects, staking, NFTs or other assets on the blockchain, there are ways to get involved without investing a lot of hard fiat currency on the experience. I especially recommend sidechains like Tezos, where gas fees are low, and artwork can be bought for under $10.

SMOLSKULL #778 — The first PFP offering on fxhash and collected at mint for 1tez ($5)

In Summary

AtFrieze 2021 in London, the traditional art world seemed mostly dismissive of the the NFT phenomena taking place online. Apart from Samsungs sponsored booth and Josh Lilly’s excellent stand, NFTs were notable largely for their absence. But despite many traditional dealers being slow to jump onto the bandwagon, NFTs look to be here to stay. In fashion, everyone from Burberry, to Louis Vuitton to Jimmy Choo have launched NFTs. And blue chip artists from Murakami and Jeff Koons to Damien Hirst and Cai Guo Qiang have either already launched NFTs or are planning to do so.

While the traditional art world hesitates, the Web3 future is being defined, and in my view, will disintermediate a lot of the current landscape of dealers which currently feed on information gaps that exists in today’s market. Some gallerists such as Joe Kennedy who launched Institut are already taking advantage of this shift and driving innovation in the primary art market. Many more will follow.

While at Frieze, I overheard a gallerist speaking to a collector who was all in on NFTs. He asked him to “explain NFTs to me as if I was a 10 year old” — The collectors response was to say “No, because a 10 year old will intuitively understand NFTs”. This tongue and cheek response hid a larger truth. For children raised fully in the digital age, the immaterial nature of NFT’s and their potential for experimentation, community building and fun are easy to grasp. Many of them have already paid hard money to unlock features and digital items within games and intuitively understand and value digital assets.

Blockchain and tokenisation are fundamentally changing how communities are built and managed. DAOs are changing how a corporation can be formed and a group of people can collaborate and an entirely new digital Web3 economy is being established before our eyes. The next three years will see general adoption of blockchain and NFTs and with luck simplified interconnected spaces to share and display collections in physical and digital environments.

Yet as we enter the new year, the NFT space is still so incredibly young. Snoop Dogg, DJ Khaled and Steph Curry all own NFTs and the NFT world is now nearly as big as the entire global Art Market. At the same time OpenSea, the largest NFT marketplace has less than 1 million total wallets which have transacted NFTs on the platform and according to Etherscan, there are only 182m Etherium wallets in existence as of Christmas Day.

NFT’s entrench the realness and meaning of immaterial things. Like Robert told me they allow creators to turn anything into something of value. Still in their early days, they are already beginning to influence how we interact with brands, value digital assets and share experiences. As the wider world begins to understand their potential, I believe now is the time to jump onboard.

Thanks to Heather Russell, Dan Murray-Serter, Tamara Lohan and Phin Jennings for reading drafts of this post. You can follow my crypto / NFT updates on Twitter