Let’s talk about Money... And art. It seems that not a week goes by in the artworld without some artist sales record being broken, either at auction or via a private sale. Behind the headlines, pricing artwork is a complicated process. In many industries, pricing is a function of the cost of materials, the time, and the skill involved in creating the object, as well as the marginal cost of creating an additional unit of that object.

With artwork, or for that matter any creative endeavour, pricing can be much more complicated and based on a wide array of factors, including but not limited to, demand, uniqueness, skill and scarcity of the artist and object being priced. Here are some of the things our curators look at when working with an artist to price work.

Primary or Secondary Market

One of the first things to look at when an artwork is priced is whether the work is being sold in the primary or secondary market. Primary sales of artworks are simply sales that deal in new works directly from the artist and artists studio. When someone refers to a gallerist as a primary or secondary market dealer, they are referring to whether the dealer works directly with artists for new market sales, or is a reseller of artworks in the secondary market. We specialise in primary market sales and work directly with the artists and galleries that represent contemporary artists.

Secondary market sales are usually a sign of a growing interest in an artist’s work, and auction houses and dealers that specialise in secondary market sales generally focus on artists with strong markets and collector bases. The prices at auction are typically dictated by the bidders in that auction, with reserve prices set for which an artwork will not be sold under. However, this does not necessarily mean that prices for art on the primary market are lower, as other considerations also factor into how a work is priced.

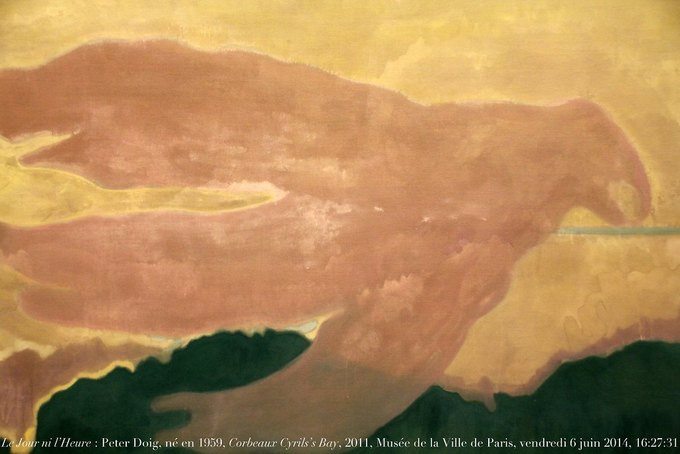

Cyril's Bay, 2011, by Peter Doig Corbeaux (from Flickr by Renaud Camus, 2014, adapted with permission)

The Artist’s Reputation

An artist’s reputation is formed by everything from the formal education they received, to the exhibition history, awards, and collections they have been featured in. Being included in prominent museum and public sector collections is a strong signal to collectors of value, as is being represented by a prominent gallery.

For example, Peter Doig set auction records in 2017 with a $28.8m painting, but leading up to this has had an extensive career spanning decades, with shows at Tate Modern, awards including the John Moores Painting prize and representation by Michael Werner.

Of course, the physical characteristics of an individual work also plays a role in pricing. Materials, scale, and uniqueness all help determine how a work is priced.

British Sculptor Anthony Gormley produces large format sculptures monumental in size. Angel of the North (1998) is Britain’s largest public sculpture, over 20m tall. The fabrication and transportation costs alone would be impossible to ignore when pricing the work. At the same time, the artist produces editions and multiples on paper, many of which are small in size, large in total editions produced and thus priced affordably.

Angel of the North, 1998, by Antony Gormley (courtesy of Wikipedia Commons)

Creative Strength

Often an artist will have a career-defining series or stage of work that stands out as a period of particular creative strength. Think of Andy Warhol and you might think of his Campbell’s Soup Can works, or Damien Hirst and his Spot Paintings. The creative strength of these works therefore stand out in price over others by the artist.

Market Dynamics

Often in the secondary market, prices are driven more by macro trends outside the artworld. The 2007 financial crash spelled disaster for many artists auction results, while the subsequent low interest rate and cheap money decade of the 2010s created more billionaires than ever before. With more money chasing limited stock of in-demand artists, auction prices for top artists have soared.

Who decides art’s value in the primary market? Ultimately the value of an artwork and an artist is never static, and no one gallery or individual has full control over an artist’s prices. Gallerists will often try to establish stable and evolving pricing for artists on their roster, gradually increasing prices over time as the artist’s reputation evolves. Many gallerists are wary of “flippers” buying and quickly selling works in secondary markets for increased profits. Their worry is justified. At times, a limited supply of an in-demand young artist’s work can create bubbles of market speculation where prices in the secondary market rise fast. This creates heightened expectations for that artist, and if prices suddenly correct, it can limit the artist’s future perceived value in the artworld. For this reason, gallerists will often vet collectors or enforce conditions on sale to ensure a work is not resold.

32 Campbell's Soup Cans, 1962, by Andy Warhol (courtesy of Wikipedia Commons)

Our Take on Pricing: 5 Tips for the New Collector

1. Buy what you love

While pricing is an important consideration, it shouldn’t be the first. When we speak with established collectors, a common theme is that the artworks they remember are the ones they truly love, not the ones they sold for the most return.

2. Research the artist

Take a look at the artist’s CV, exhibition history and learn about the practice. On Rise Art we have this information on the profile page of each artist.

3. Primary vs. Secondary

Consider where you want to purchase work. Buying established artists’ work from secondary dealers and auction houses enables anyone to access works by well-known names at market prices. However, primary market purchases directly support artists, as the proceeds from the sale are split by the galleries and the artist themself. At Rise Art, we work in the primary market and do so to directly support artists on the rise.

4. Don’t be afraid to ask for discounts in the primary market

Often gallerists will discount 5-10% on published prices, especially for valued collectors. Art professionals often talk to collectors about all aspects of an artwork – including pricing.

5. Is it worth it?

The main thing to decide is whether you like the piece enough to justify the cost. Buying art is not only a financial investment but an investment for yourself – especially if the artwork is for you. If the piece in question gets you in the feels every time you see it, it is worth the gamble.

Chowwai Cheung

Chowwai Cheung Fred Ingrams

Fred Ingrams Sophie Green

Sophie Green Day Bowman

Day Bowman Daisy Cook

Daisy Cook Halima Cassell

Halima Cassell Barbara Rae

Barbara Rae Patrick Hughes

Patrick Hughes Bruce Mclean

Bruce Mclean Nelson Makamo

Nelson Makamo Sandra Blow

Sandra Blow Tracey Emin

Tracey Emin